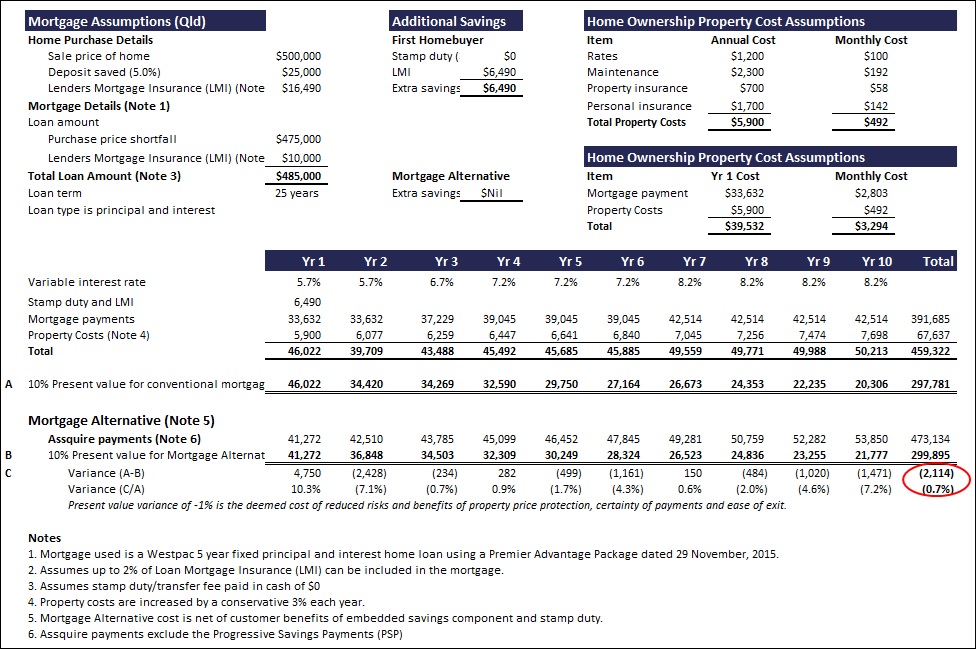

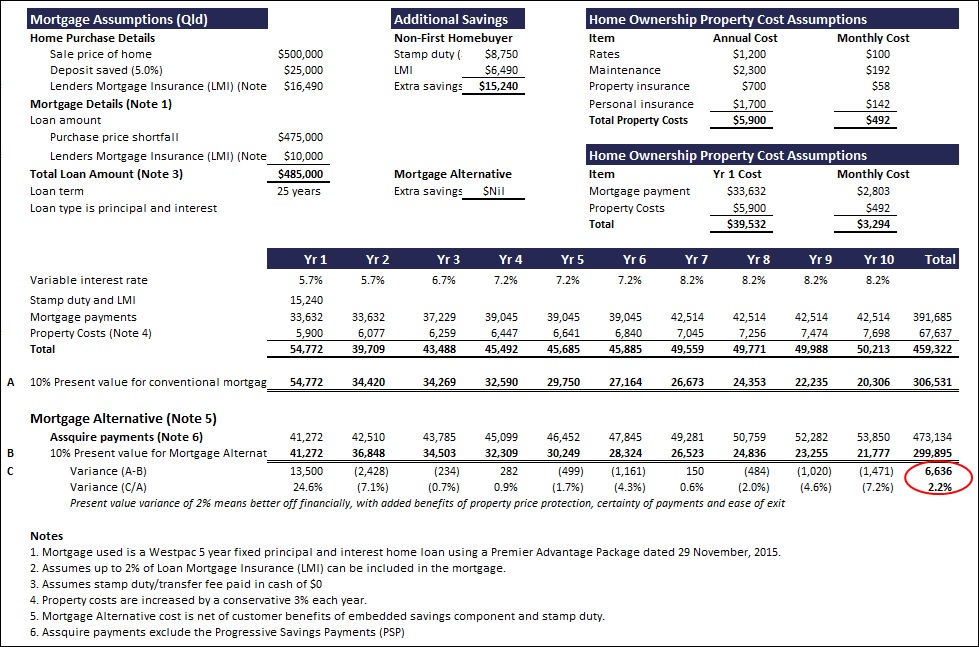

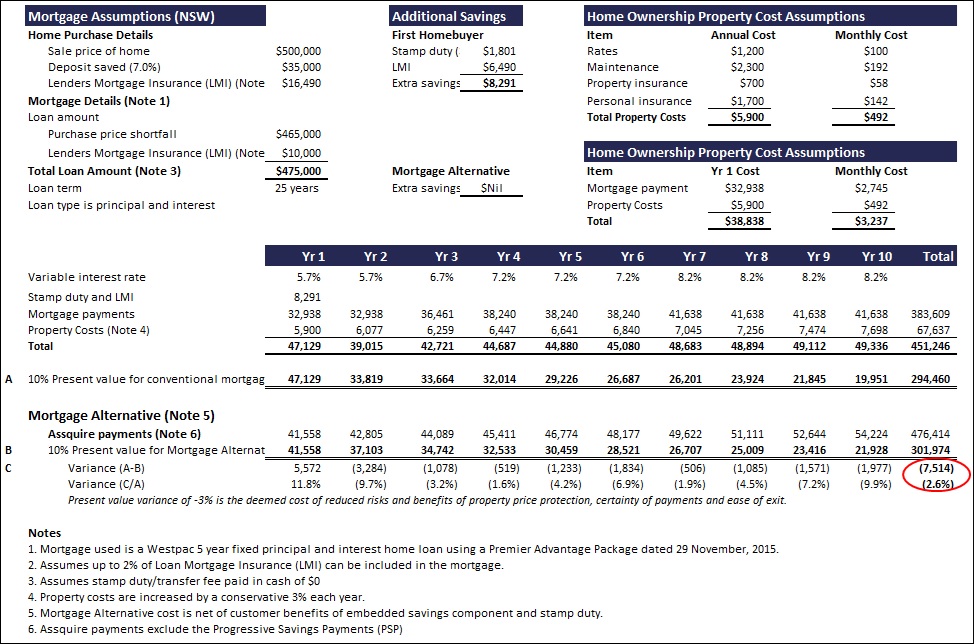

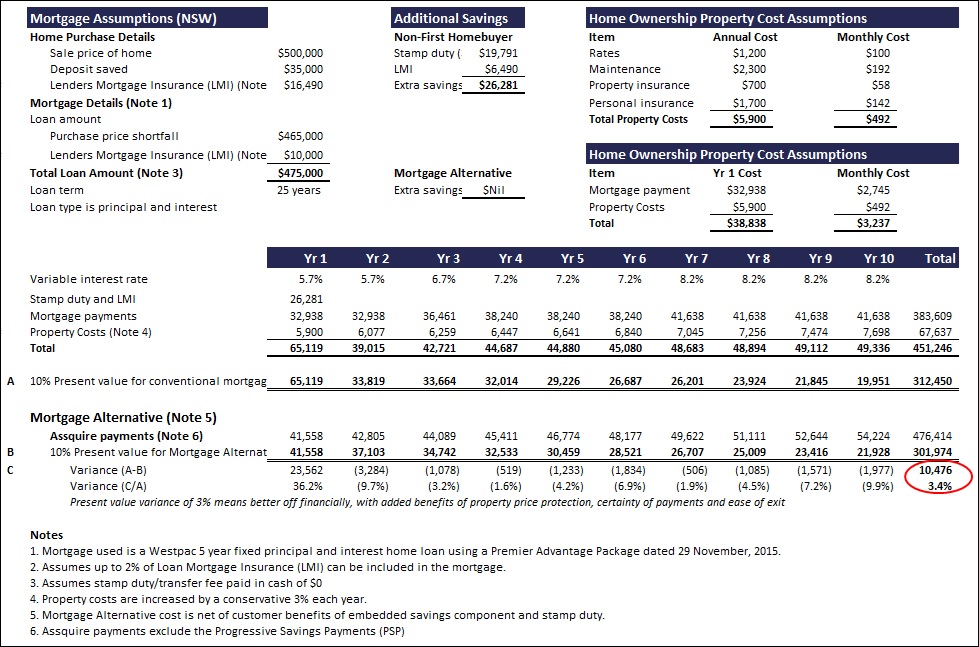

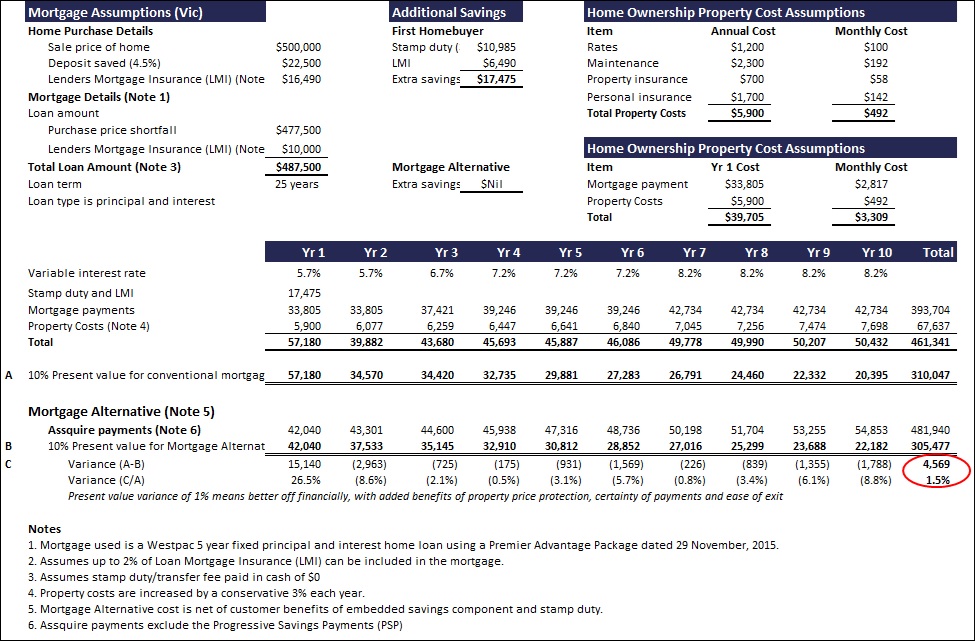

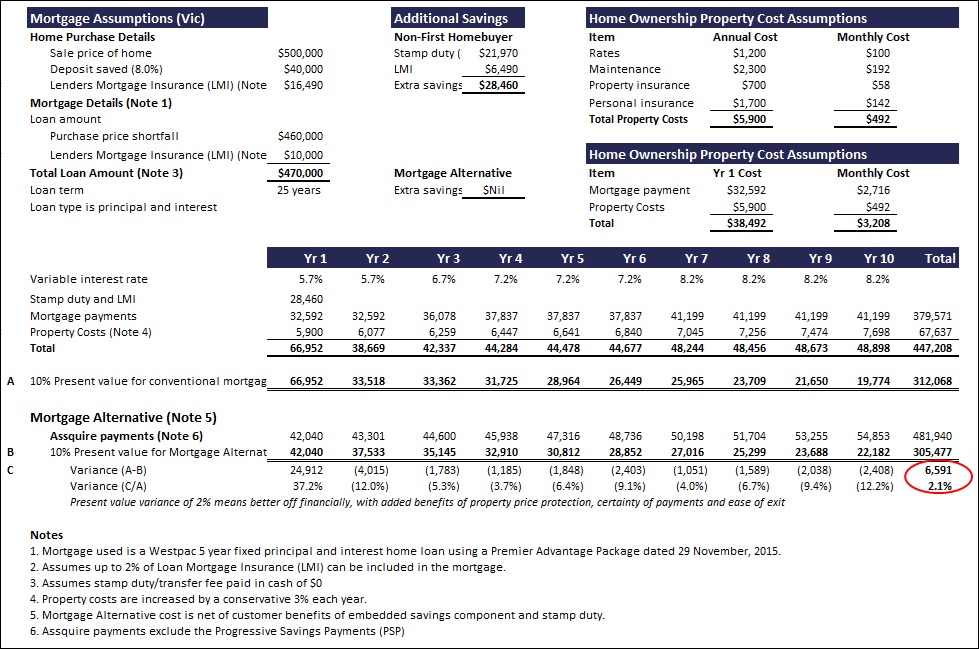

The table shows that a customer using Mortgage Alternative will pay roughly the same total costs as a mortgage, a little more, but with much more certainty and considerably reduced risk (so long as they stay put and do not need to exit unexpectedly before they can settle)! This is a risk that only the buyer can assess for themselves.

Less Risk

For a buyer that can commit to a strict savings plan and who is prepared to live in the home until the terms of sale are completed, the Mortgage Alternative product is considerably less risk to a purchaser than a standard mortgage.

How is this so?

Well, first and foremost you have NO DEBT! We are not lending you money so you don’t have the burden of having a massive mortgage to keep you awake at night. You enter into a purchase contract (with a Buyer’s mortgage registered on title to secure your deposit and excess rents over the norm) with a settlement date up to ten years into the future. You live in the home immediately under a lease (with normal Residential Tenancy laws protections) after agreeing to buy the home in ten years (or earlier if you can afford it) for a pre-agreed fixed price. You enjoy all of the benefits of home ownership NOW without the burden of a huge debt. But you will pay much more than rent.

Secondly, you are not at the mercy of changing interest rates. Your monthly payments are outlined in your contract right up until settlement. With a standard mortgage, you are forced to choose what is going to happen to interest rates and then gamble on whether to fix your rate or leave it exposed to future fluctuations.

Thirdly, and perhaps most importantly, with Mortgage Alternative you can settle at the time of your choosing prior to the contract settlement date for the pre-agreed purchase price, or you can (if certain Take Back events specified in the contract affect your ability to meet your settlement obligations) walk away from your contract (in defined circumstances) and vacate the property, giving up all capital growth during your occupancy period to the investor. Whilst wou will have lost alll of your deposit payments and inflated rents in that circumstance, with a standard mortgage, you remain liable for your mortgage debt until it is paid back to the bank and you are exposed from day one to future property price fluctuations – including any severe property price slump.

Fourth, there is no pricing risk. You contract to buy your home at a pre-agreed price – which is escalated from today’s market value (a value confirmed by an independent valuation panel commissioned by Haigslea Residential Limited from a panel of independent valuers) or an Agreed Value that you strike with the seller today.

Escalation is by a relatively small percentage annually, that takes account of the inflated rents you are paying the seller each month. This escalated price is effectively your option to settle at any time during the contract period – but you must pay the year ten price in the event that you choose to settle early – clearly, you need to be serious about home ownership and occupying the property as your principal place of residence to take Mortgage Alternative.

Nevertheless, if you get to the end of your contract and find that the market value of your home then is far less than the contracted price, you are free to vacate the property and walk away from the purchase if you meet the contract conditions and cannot afford to settle. The contract conditions set out circumstances likely to materially affect your ability to complete your settlement obligations. Of course, in this case, the investor retains the property and all capital growth (if any) during the MA period.

Mortgage Alternative is vastly different to a mortgage and clearly the most innovative path to home ownership for those people looking to get a foot on the property ladder, but who don’t want to save for years to make up a deposit and be exposed to hefty mortgage insurance costs. If this sounds like you, then lodge your application today.